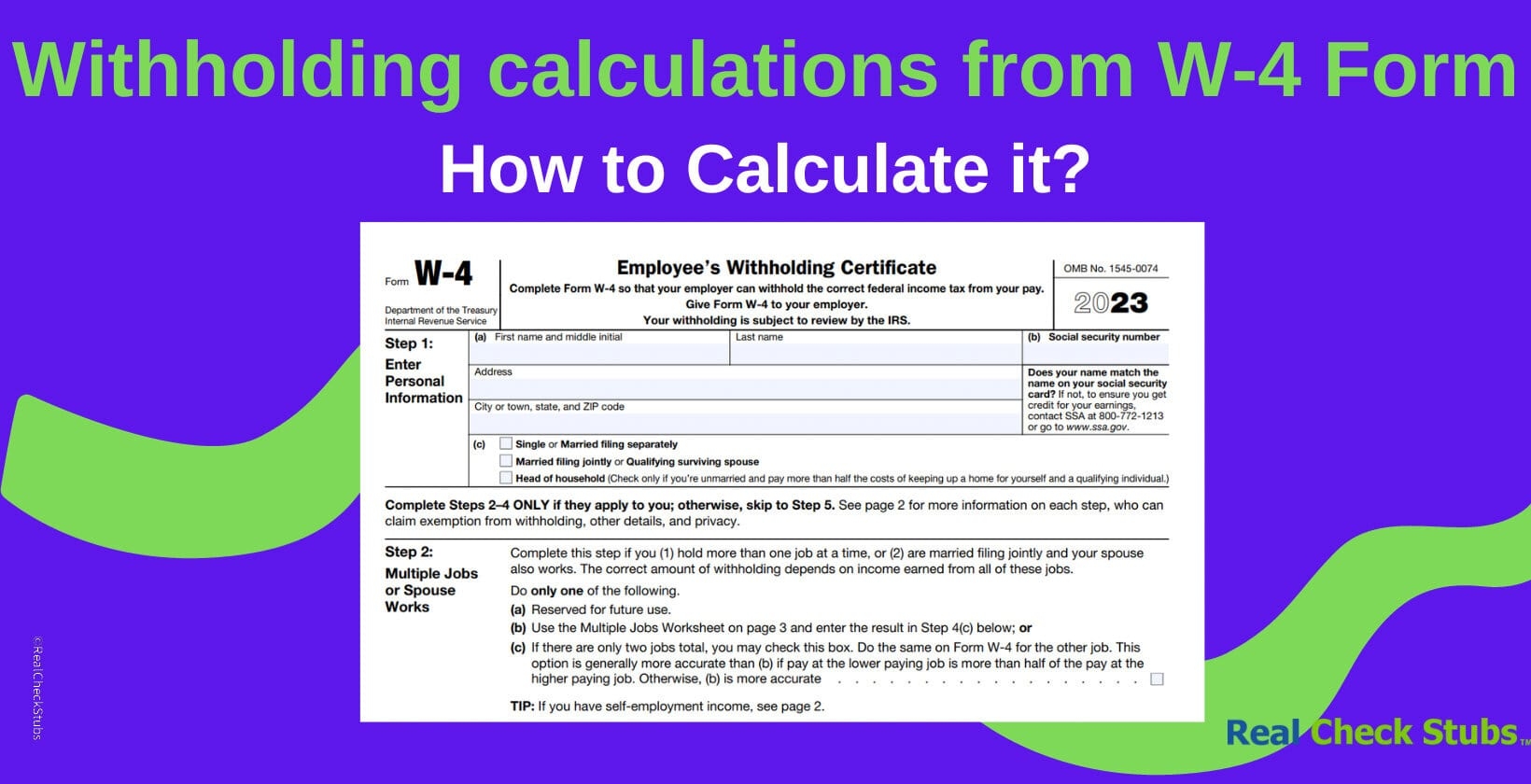

When starting a new job, one of the first things you will need to do is fill out a W4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. One important part of the W4 form is the deductions worksheet, which helps you calculate the number of allowances you should claim.

It’s crucial to fill out the deductions worksheet correctly to avoid having too much or too little tax withheld from your paycheck. By claiming the right number of allowances, you can ensure that you don’t end up with a large tax bill at the end of the year or a significantly reduced paycheck each pay period.

W4 Deductions Worksheet

The W4 deductions worksheet is divided into two parts: one for those with a job and another for those with a spouse who works. In these worksheets, you will need to enter information such as your filing status, number of dependents, and any additional income you expect to earn during the year.

Based on the information you provide, the deductions worksheet will help you determine the total number of allowances you should claim on your W4 form. This number will directly impact how much federal income tax is withheld from your paycheck, so it’s important to be as accurate as possible when filling out the worksheet.

Remember that you can always update your W4 form throughout the year if your circumstances change, such as getting married, having a child, or taking on a second job. By keeping your W4 form up to date, you can ensure that you are having the right amount of tax withheld from your paycheck.

Overall, the W4 deductions worksheet is a valuable tool that can help you navigate the complex world of federal income tax withholding. By taking the time to fill out this worksheet accurately, you can avoid any surprises come tax time and ensure that you are maximizing your take-home pay each pay period.

So, next time you start a new job or experience a significant life change, be sure to revisit your W4 form and update your deductions worksheet accordingly. Your financial future will thank you!