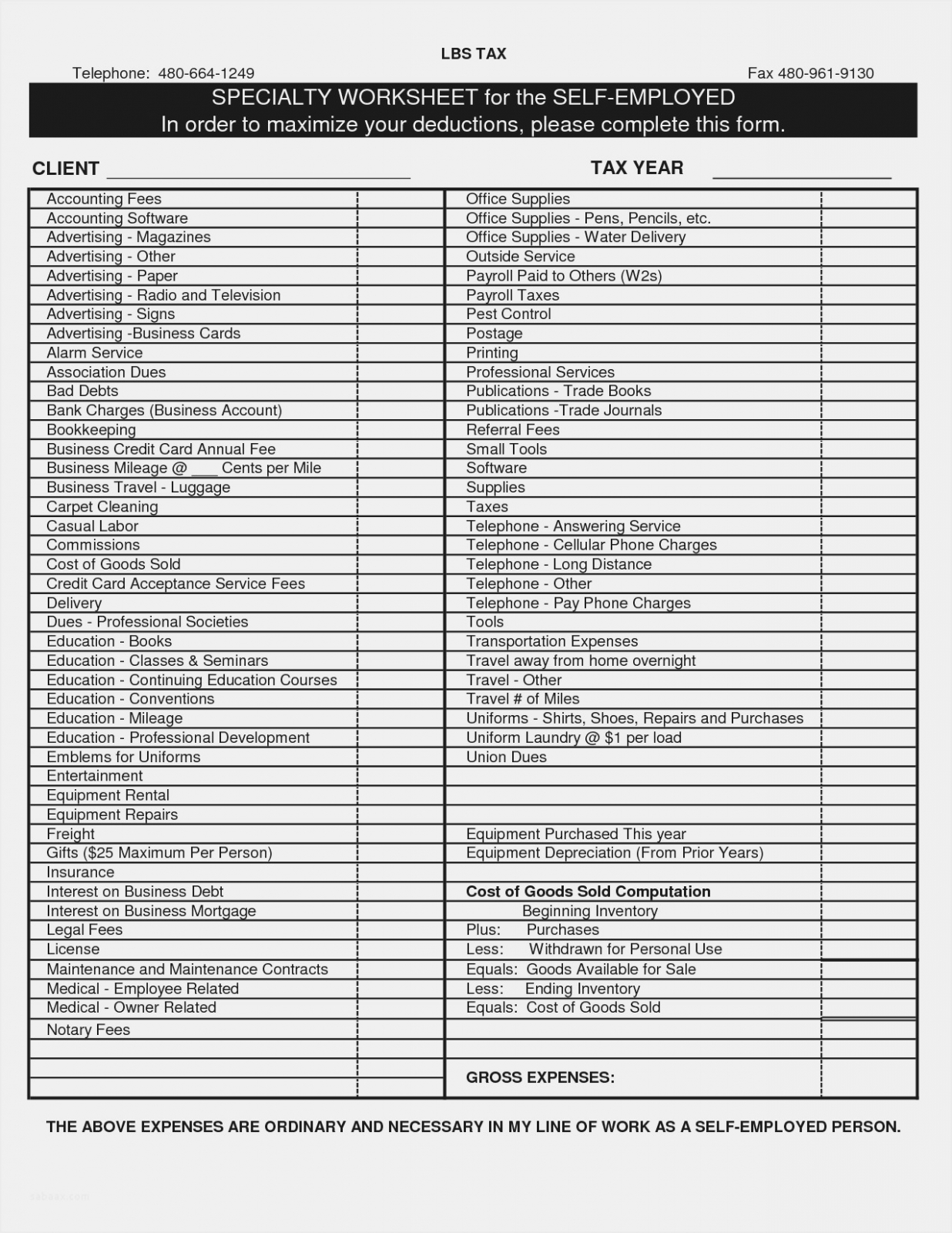

Being self-employed comes with many benefits, but it also means you are responsible for handling your own taxes. One of the key aspects of ensuring you maximize your deductions and minimize your tax liability is keeping track of all your business expenses. This is where a self-employed tax deductions worksheet can be incredibly helpful.

A self-employed tax deductions worksheet is a tool that allows you to organize and categorize your expenses in a way that makes it easy to identify which ones are deductible. By keeping meticulous records and using a worksheet, you can ensure you are not missing out on any potential deductions that could save you money come tax time.

When using a self-employed tax deductions worksheet, it’s important to include all relevant expenses related to your business. This can include things like office supplies, advertising costs, travel expenses, and even a portion of your home office expenses if you work from home. By categorizing these expenses and keeping track of them throughout the year, you can save yourself time and stress when it comes time to file your taxes.

One key benefit of using a self-employed tax deductions worksheet is that it helps you stay organized and prepared in case of an audit. By having all your expenses neatly documented and categorized, you can easily provide the necessary documentation to support your deductions if needed. This can give you peace of mind knowing that you are in compliance with tax laws and regulations.

In addition to helping you identify and track deductible expenses, a self-employed tax deductions worksheet can also help you plan for the future. By seeing where your money is going and which expenses are the most significant, you can make informed decisions about your business and potentially find ways to reduce costs in the future.

Overall, a self-employed tax deductions worksheet is a valuable tool for any self-employed individual looking to maximize their deductions and minimize their tax liability. By using this worksheet to track and organize your expenses, you can save time, money, and stress when it comes time to file your taxes.