When it comes to financial planning and retirement savings, one tool that is commonly used is the RMD worksheet. RMD stands for Required Minimum Distribution, which is the minimum amount of money that must be withdrawn from certain retirement accounts once a person reaches a certain age. This tool helps individuals calculate how much they are required to withdraw each year to avoid penalties and ensure they are in compliance with IRS regulations.

Understanding how to use an RMD worksheet is crucial for anyone who has retirement savings in tax-deferred accounts such as traditional IRAs or 401(k) plans. By calculating and planning for these required distributions, individuals can better manage their retirement income and tax obligations as they age.

What is an RMD Worksheet?

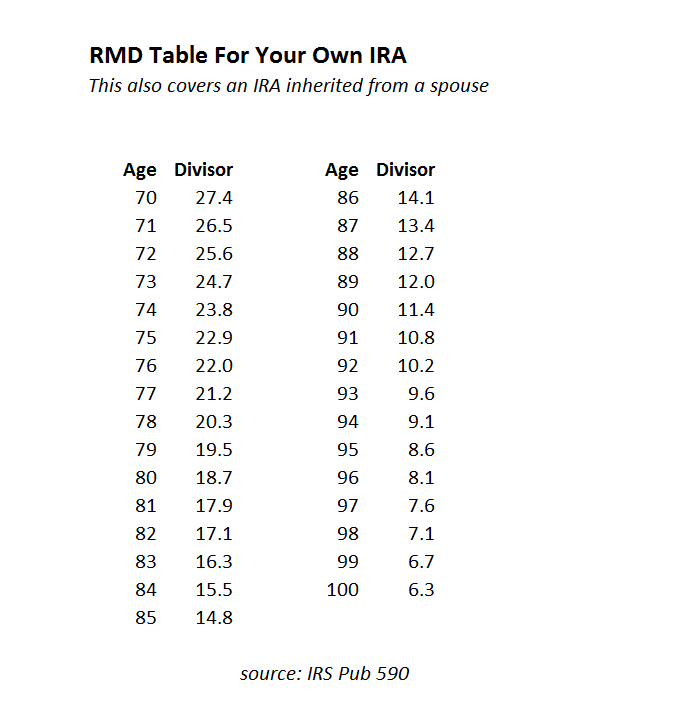

An RMD worksheet is a form or calculator that helps individuals determine the amount they are required to withdraw from their retirement accounts each year. It takes into account factors such as the individual’s age, account balance, and life expectancy to calculate the minimum distribution amount. This tool is essential for ensuring that retirees do not incur penalties for failing to withdraw the required minimum amount from their accounts.

Using an RMD worksheet can also help individuals better plan for their retirement income needs. By knowing how much they are required to withdraw each year, retirees can budget and allocate their funds accordingly. This can help them avoid running out of money in retirement and ensure that they are able to maintain their desired standard of living.

Additionally, an RMD worksheet can be a valuable tool for tax planning. By understanding how required minimum distributions impact their taxable income, individuals can make informed decisions about when and how to withdraw funds from their retirement accounts. This can help them minimize their tax liability and make the most of their retirement savings.

In conclusion, the RMD worksheet is a crucial tool for individuals with retirement savings in tax-deferred accounts. By using this tool to calculate and plan for required minimum distributions, retirees can ensure they are in compliance with IRS regulations, manage their retirement income effectively, and make informed decisions about their tax obligations. Understanding and utilizing the RMD worksheet is essential for successful retirement planning.