As more homeowners look for ways to reduce their carbon footprint and save on energy costs, clean energy solutions have become increasingly popular. The Residential Clean Energy Credit is a tax credit designed to incentivize the adoption of clean energy technologies in residential properties. To determine the credit limit for your clean energy upgrades, you will need to fill out the Residential Clean Energy Credit Limit Worksheet.

The worksheet is a tool provided by the IRS to help taxpayers calculate their eligible credit amount based on the costs incurred for qualified clean energy improvements. This includes expenses related to solar panels, geothermal heat pumps, small wind turbines, and fuel cells installed in a taxpayer’s primary residence.

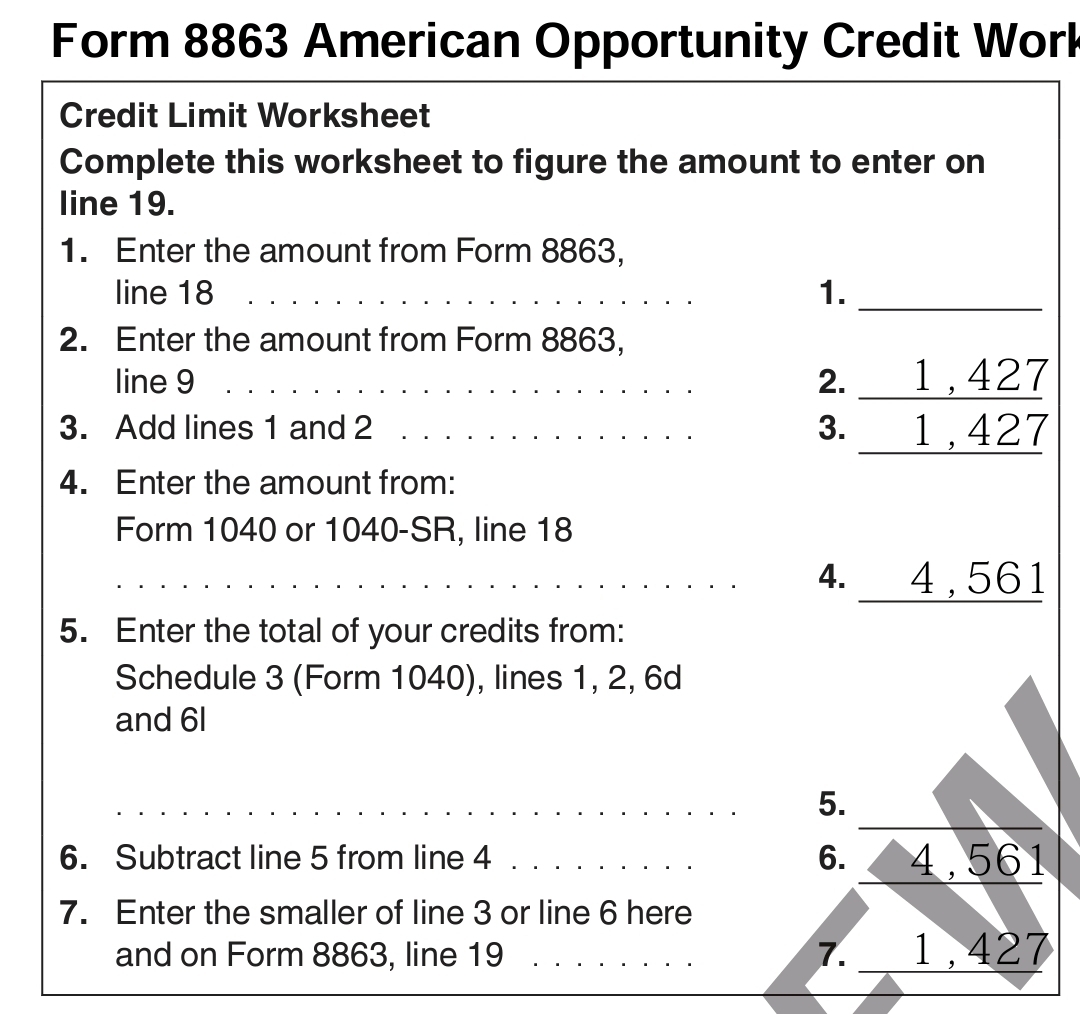

Residential Clean Energy Credit Limit Worksheet

When filling out the worksheet, you will need to gather documentation of your clean energy expenditures, such as invoices, receipts, and manufacturer certifications. The worksheet will guide you through the process of determining the total costs eligible for the credit, taking into account any other incentives or rebates received for the same improvements.

Once you have calculated your eligible costs, the worksheet will help you determine the maximum credit amount you can claim on your tax return. It’s important to note that the credit is subject to certain limitations based on the type of clean energy system installed and the taxpayer’s overall tax liability.

By utilizing the Residential Clean Energy Credit Limit Worksheet, homeowners can take advantage of tax incentives to offset the upfront costs of clean energy upgrades and make their homes more energy-efficient. Not only does this benefit the environment, but it also leads to long-term savings on energy bills.

In conclusion, the Residential Clean Energy Credit Limit Worksheet is a valuable tool for homeowners looking to invest in clean energy solutions for their properties. By following the guidelines provided in the worksheet, taxpayers can accurately calculate their credit limit and maximize their tax savings. Consider consulting with a tax professional for assistance in completing the worksheet and ensuring compliance with IRS regulations.