When it comes to investing, understanding the tax implications of your earnings is crucial. Qualified dividends and capital gains are two types of income that are subject to special tax rates. The IRS has specific guidelines for how these earnings are taxed, and it’s important for investors to be aware of these rules to avoid any surprises come tax season.

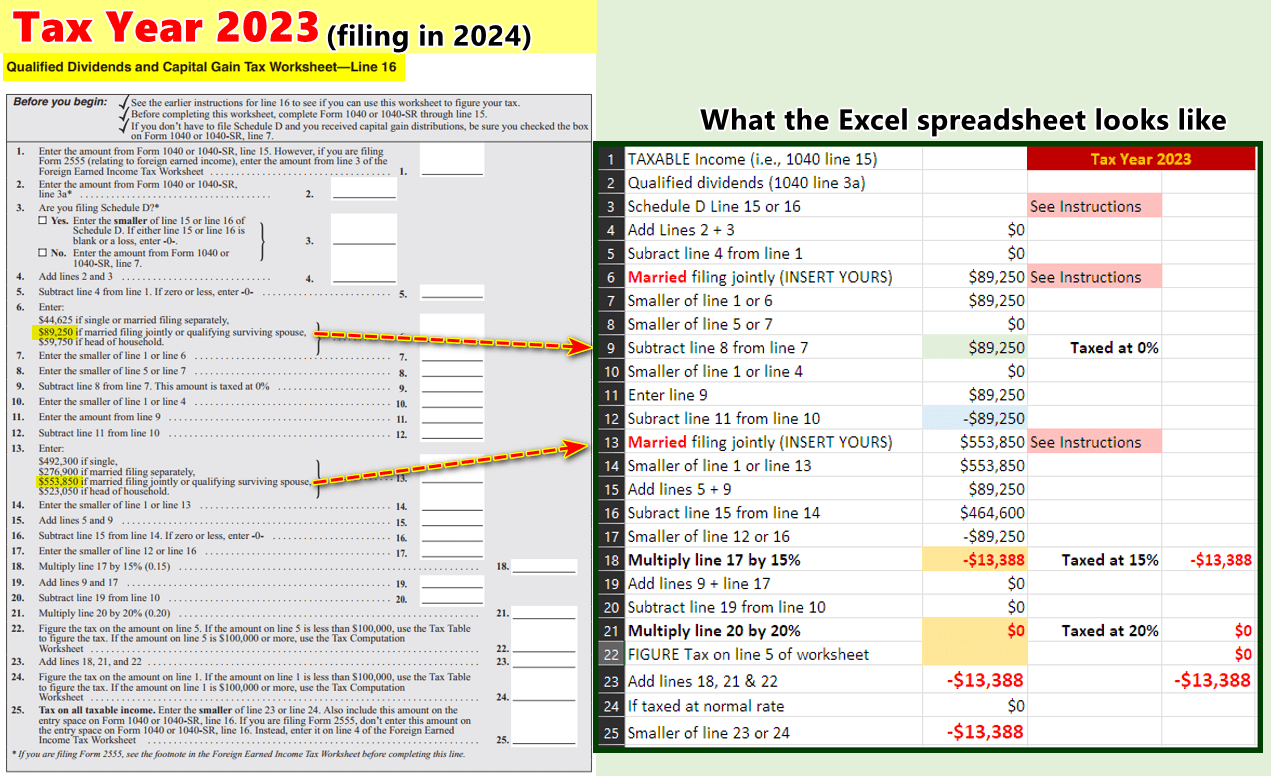

For the year 2023, the IRS has released the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of tax they owe on these types of income. This worksheet takes into account various factors such as filing status, taxable income, and the type of investment income received. By following this worksheet, taxpayers can accurately determine their tax liability and ensure they are in compliance with the IRS guidelines.

Qualified Dividends and Capital Gain Tax Worksheet 2023

The Qualified Dividends and Capital Gain Tax Worksheet for 2023 is designed to help taxpayers determine the tax they owe on their qualified dividends and capital gains. This worksheet takes into account the specific tax rates that apply to these types of income, which are generally lower than ordinary income tax rates. By following the instructions on the worksheet and inputting the relevant information, taxpayers can calculate their tax liability accurately.

One key aspect of the worksheet is determining the taxpayer’s total taxable income, which includes not only qualified dividends and capital gains but also other sources of income. By subtracting deductions and adjustments, taxpayers can arrive at their adjusted gross income, which is used to calculate the tax owed on qualified dividends and capital gains.

Additionally, the worksheet provides instructions for determining the tax rate that applies to qualified dividends and capital gains based on the taxpayer’s filing status and income level. By following these guidelines, taxpayers can ensure they are paying the correct amount of tax on their investment income and avoid any penalties or fines for underpayment.

In conclusion, the Qualified Dividends and Capital Gain Tax Worksheet for 2023 is a valuable tool for investors who receive income from dividends and capital gains. By following the instructions on the worksheet and accurately inputting the relevant information, taxpayers can calculate their tax liability with confidence and ensure they are in compliance with the IRS guidelines.