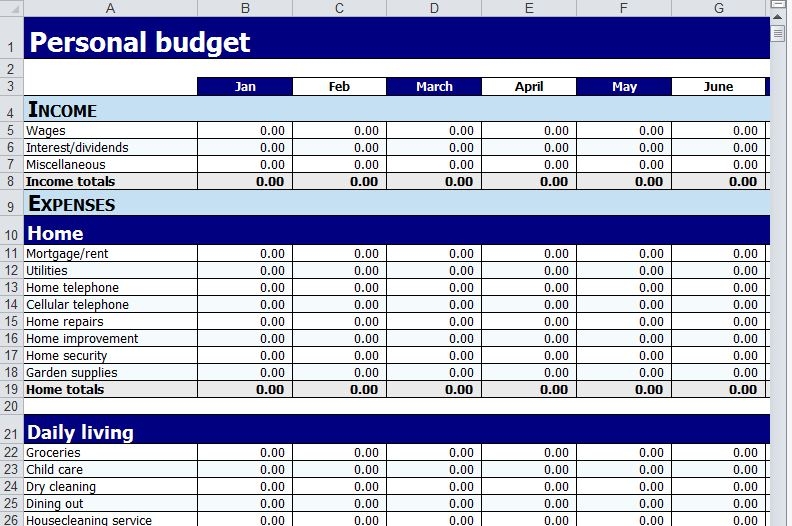

Managing personal finances can be a daunting task, but with the help of a personal budget worksheet in Excel, it becomes much easier. This tool allows individuals to track their income and expenses, set financial goals, and make informed decisions about their money. By using Excel, users can customize their budget worksheet to fit their specific needs and preferences, making it a valuable tool for financial planning.

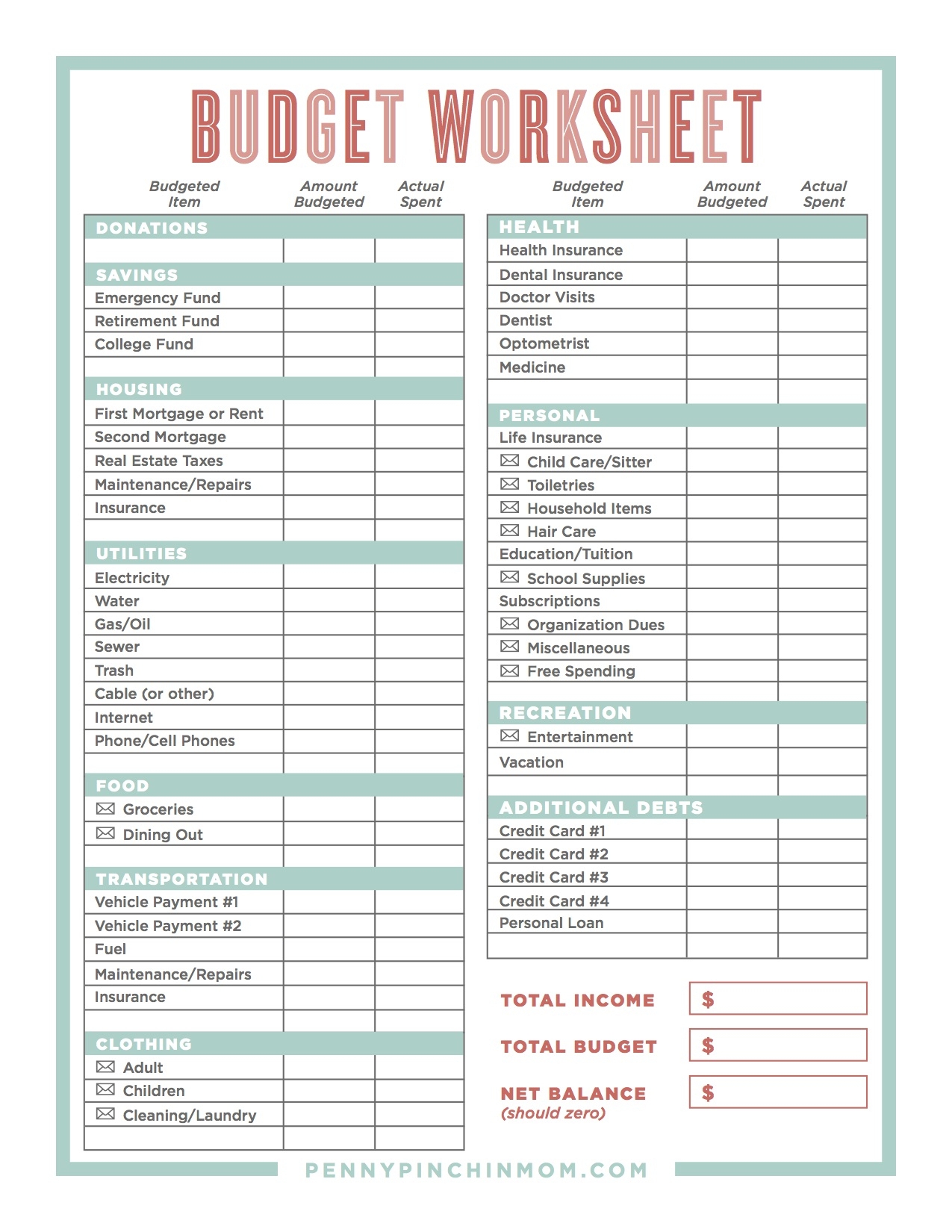

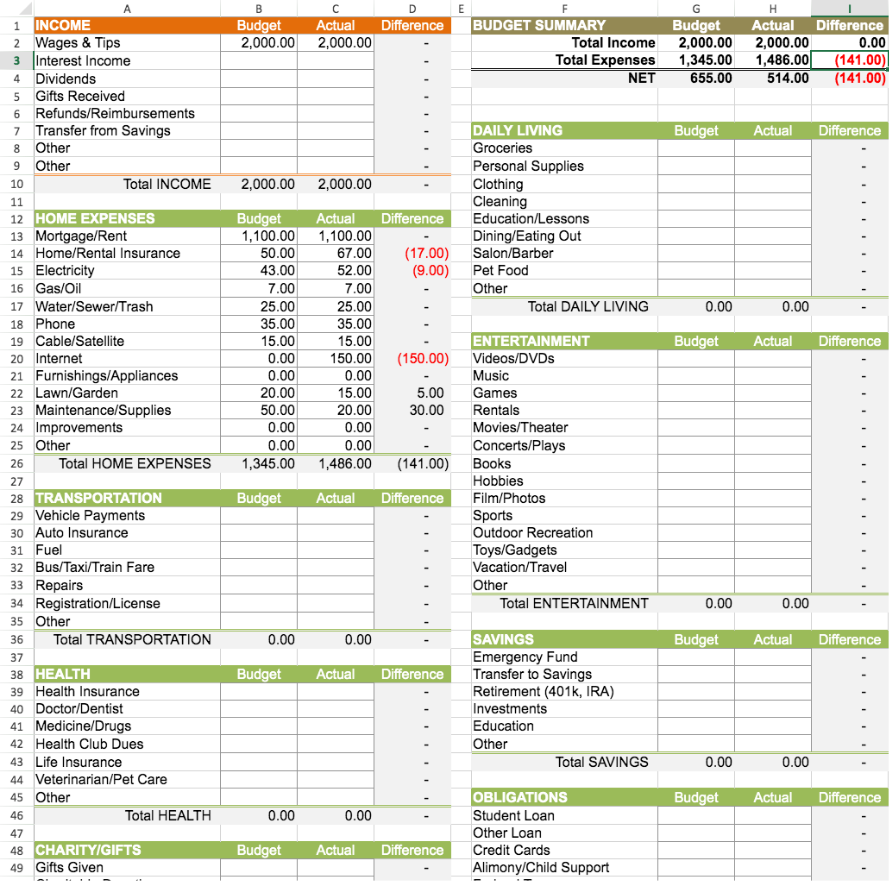

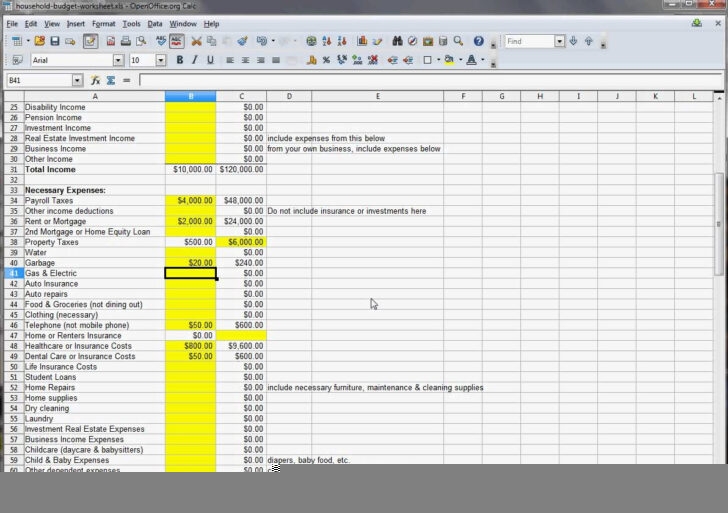

One of the key benefits of using a personal budget worksheet in Excel is its versatility. Users can easily input their income sources, such as salary, investments, and side hustles, and track their expenses in various categories like housing, transportation, and entertainment. This allows individuals to see where their money is going and identify areas where they can cut back or save more.

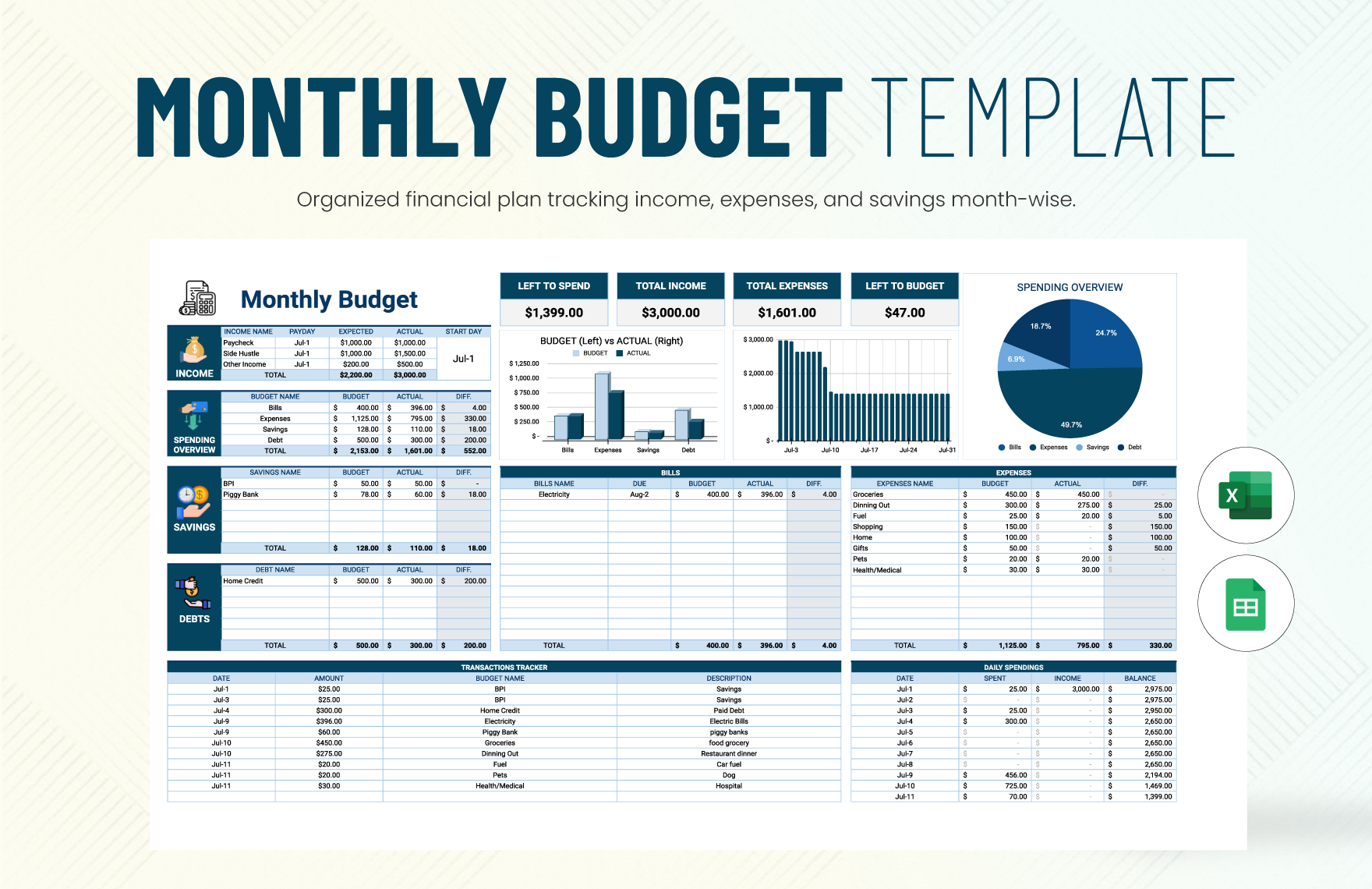

Another advantage of using Excel for budgeting is the ability to create visual representations of financial data. Users can easily generate graphs and charts to visualize their income, expenses, savings, and debt over time. This visual aid can help individuals understand their financial situation better and make more informed decisions about their money management.

Additionally, Excel offers powerful tools for analyzing financial data, such as formulas, functions, and pivot tables. Users can perform calculations, compare data, and identify patterns to gain deeper insights into their finances. This analytical capability can help individuals set realistic financial goals, track their progress, and make adjustments as needed to stay on track.

In conclusion, a personal budget worksheet in Excel is a valuable tool for managing personal finances effectively. By customizing the worksheet to fit their specific needs, users can track their income and expenses, set financial goals, and make informed decisions about their money. With the versatility, visual aids, and analytical tools that Excel provides, individuals can take control of their finances and work towards a secure financial future.