When it comes to buying a home, most people require a mortgage to finance the purchase. One important aspect of having a mortgage is being able to deduct the interest paid on it from your taxes. However, there are limitations on how much interest you can deduct, and it is crucial to keep track of these deductions accurately.

One way to ensure you are maximizing your deductions is by using a mortgage interest limitation worksheet. This worksheet helps you calculate the amount of mortgage interest you can deduct based on certain limitations set by the IRS. By using this worksheet, you can make sure you are not missing out on any deductions and are staying compliant with tax laws.

Mortgage Interest Limitation Worksheet

The mortgage interest limitation worksheet typically includes sections where you input information such as your total mortgage interest paid for the year, the amount of your mortgage loan, and any limitations that may apply based on your income level. By filling out this worksheet accurately, you can determine the maximum amount of mortgage interest you can deduct on your taxes.

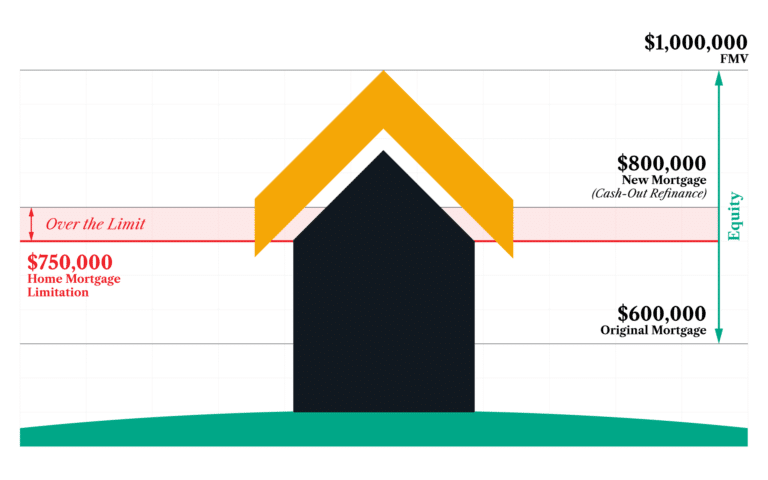

It is important to note that the Tax Cuts and Jobs Act of 2017 made changes to the mortgage interest deduction rules, limiting the amount of mortgage debt on which you can deduct interest. This makes it even more crucial to use a mortgage interest limitation worksheet to ensure you are deducting the correct amount and staying within the limits set by the IRS.

In addition to helping you calculate your deductions, a mortgage interest limitation worksheet can also serve as documentation in case of an IRS audit. By keeping accurate records and calculations, you can provide proof of your deductions and avoid any potential penalties or fines.

Overall, using a mortgage interest limitation worksheet is essential for homeowners who want to maximize their deductions and stay in compliance with tax laws. By carefully tracking your mortgage interest payments and deductions, you can ensure you are taking full advantage of the tax benefits of homeownership.

Make sure to consult with a tax professional or financial advisor if you have any questions or concerns about your mortgage interest deductions and how to use a limitation worksheet effectively.