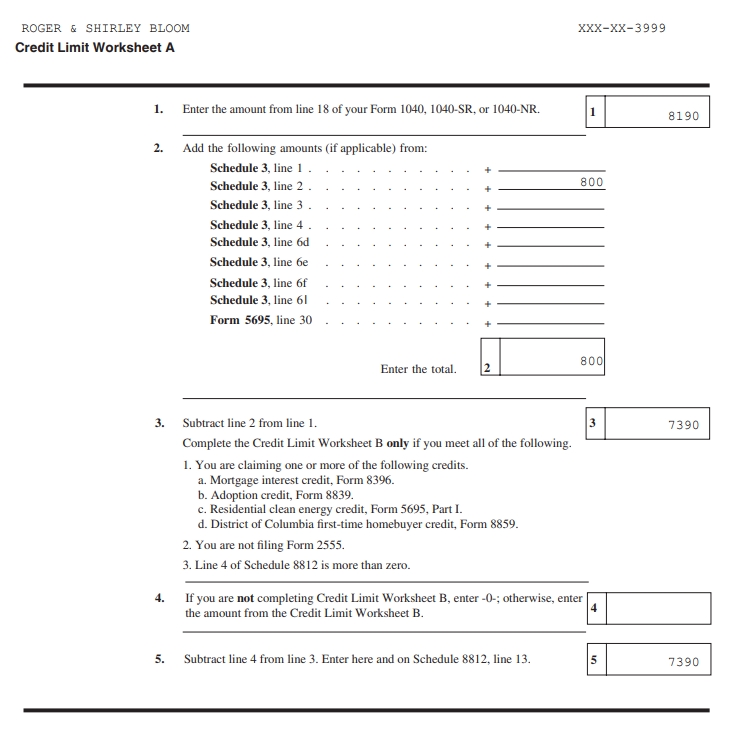

When it comes to taxes, there are various deductions and credits that can help individuals reduce their tax liability. One such credit is the Child and Dependent Care Credit, which can be claimed by taxpayers who have incurred expenses for the care of a qualifying individual while they are at work or looking for work. To determine the amount of credit that can be claimed, taxpayers must fill out IRS Credit Limit Worksheet A.

IRS Credit Limit Worksheet A is a form that helps taxpayers calculate the maximum amount of the Child and Dependent Care Credit that they can claim. It takes into account various factors such as the taxpayer’s income, the number of qualifying individuals, and the amount of expenses incurred for their care. By filling out this worksheet, taxpayers can ensure that they are claiming the correct amount of credit on their tax return.

When filling out IRS Credit Limit Worksheet A, taxpayers will need to provide information such as their adjusted gross income, the amount of expenses incurred for the care of qualifying individuals, and any other credits they may be eligible for. The worksheet will then calculate the maximum amount of the Child and Dependent Care Credit that can be claimed based on this information.

It is important for taxpayers to carefully review and accurately fill out IRS Credit Limit Worksheet A to ensure that they are claiming the correct amount of the Child and Dependent Care Credit. Failing to do so could result in an incorrect claim, which may lead to penalties or additional taxes owed. By following the instructions provided on the worksheet and double-checking all calculations, taxpayers can avoid potential issues with their tax return.

In conclusion, IRS Credit Limit Worksheet A is a valuable tool for taxpayers who are looking to claim the Child and Dependent Care Credit. By providing accurate information and following the instructions carefully, taxpayers can ensure that they are claiming the correct amount of credit on their tax return. It is important to take the time to fill out this worksheet correctly to avoid any potential issues with the IRS.