When you reach a certain age, typically 72 years old, the IRS requires you to start taking distributions from your traditional IRA accounts. These mandatory withdrawals are known as Required Minimum Distributions (RMDs) and failing to take them can result in hefty penalties. To calculate the amount you must withdraw each year, you can use an IRA Required Minimum Distribution Worksheet.

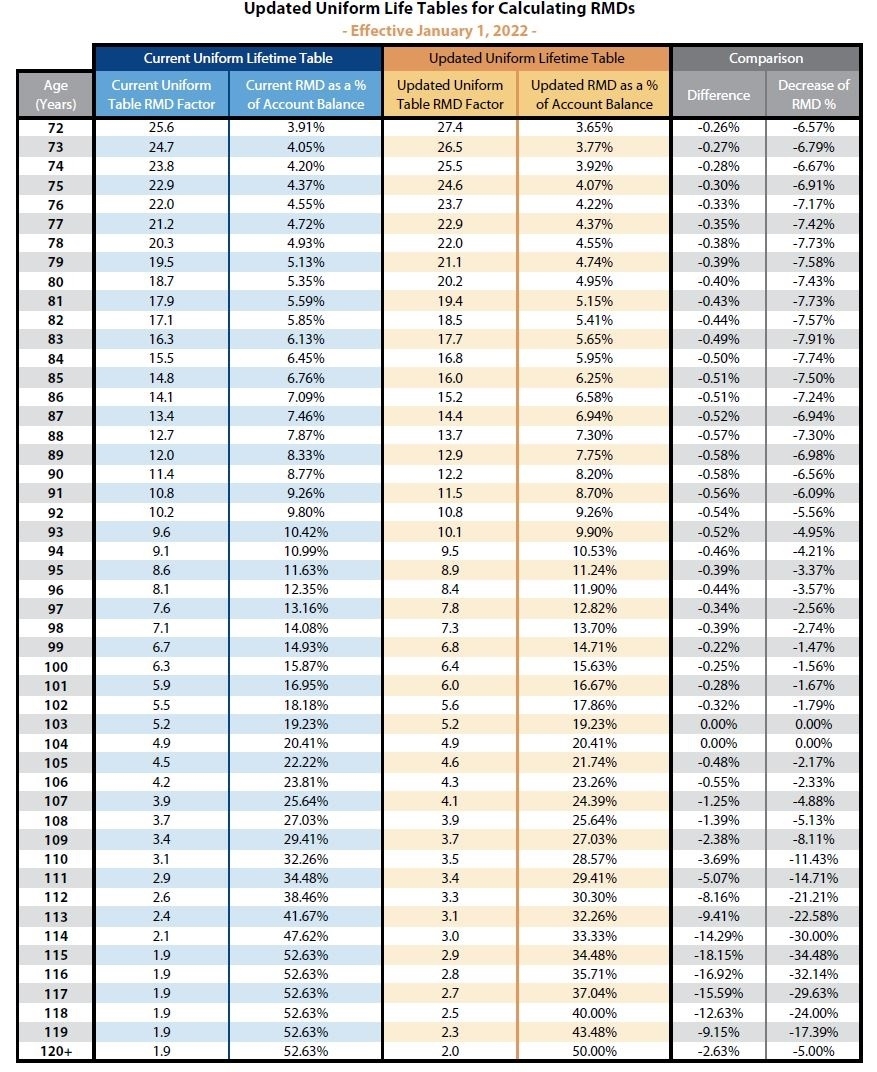

The IRS provides a worksheet to help you calculate your RMDs based on your age, account balance, and other factors. By using this worksheet, you can determine the minimum amount you must withdraw from your IRA each year to avoid penalties. The calculation takes into account your life expectancy and the total value of your IRA accounts.

It’s important to note that if you have multiple traditional IRA accounts, you can calculate the RMD for each account separately or aggregate the total and take the distribution from one account. Using the worksheet can help you make informed decisions about how to best manage your retirement savings and comply with IRS regulations.

Factors such as your age, marital status, and beneficiary designation can also impact your RMD calculation. By inputting the relevant information into the worksheet, you can ensure that you are meeting the IRS requirements and avoiding any unnecessary penalties. It’s crucial to stay on top of your RMDs to avoid any surprises come tax time.

Additionally, if you have a Roth IRA, you are not required to take RMDs during your lifetime. This can be a significant advantage for those who want to continue growing their retirement savings tax-free. However, it’s essential to understand the rules and regulations surrounding RMDs to ensure you are in compliance with the IRS.

In conclusion, using an IRA Required Minimum Distribution Worksheet can help you navigate the complex rules surrounding RMDs and ensure that you are meeting your obligations to the IRS. By understanding how to calculate your RMDs and staying informed about any changes to the regulations, you can make the most of your retirement savings and avoid any unnecessary penalties.