When faced with financial difficulties, individuals and businesses may find themselves in a situation where they are unable to pay their debts. This is known as insolvency, and it can be a complex and stressful situation to navigate. In order to assess their financial situation and determine the best course of action, individuals and businesses may use an insolvency worksheet.

An insolvency worksheet is a tool that helps individuals and businesses organize their financial information, assess their assets and liabilities, and calculate their insolvency ratio. This ratio is used to determine whether an individual or business is insolvent, meaning their liabilities exceed their assets.

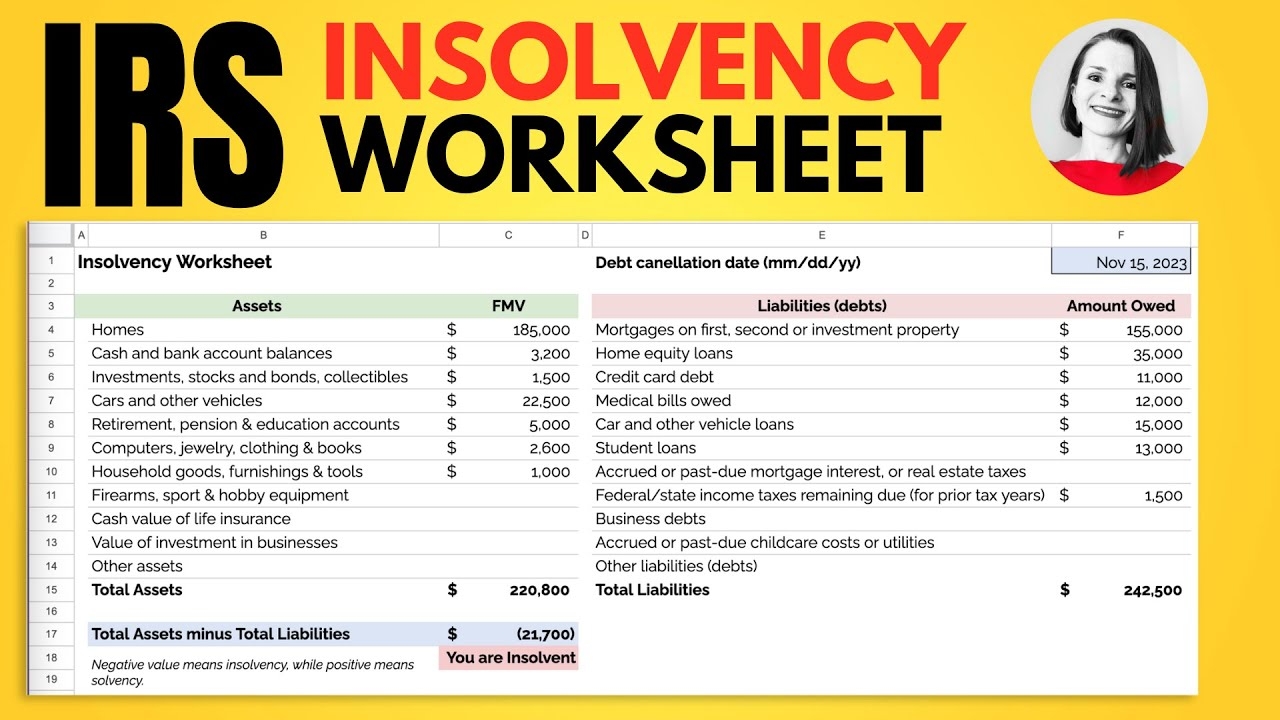

Insolvency Worksheet

When filling out an insolvency worksheet, individuals and businesses will typically list all of their assets, including cash, investments, real estate, vehicles, and personal property. They will also list all of their liabilities, including loans, credit card debt, mortgages, and other financial obligations.

After listing their assets and liabilities, individuals and businesses will calculate their insolvency ratio by dividing their total liabilities by their total assets. If the resulting ratio is greater than 1, it indicates that the individual or business is insolvent.

Once the insolvency ratio has been calculated, individuals and businesses can use this information to determine the best course of action. This may include negotiating with creditors, filing for bankruptcy, or seeking alternative solutions to address their financial difficulties.

It’s important to note that insolvency worksheets are just one tool that can be used to assess financial situations. It’s always recommended to seek the guidance of a financial professional or insolvency expert when facing insolvency in order to explore all available options and make informed decisions.

In conclusion, an insolvency worksheet is a valuable tool that can help individuals and businesses assess their financial situation and determine the best course of action when facing insolvency. By organizing their financial information and calculating their insolvency ratio, individuals and businesses can take proactive steps to address their financial difficulties and work towards a more stable financial future.