When it comes to calculating your state income tax withholdings in Illinois, it’s important to understand the Illinois Withholding Allowance Worksheet. This worksheet helps you determine how much state income tax should be withheld from your paycheck based on your filing status, number of allowances, and any additional withholding amounts you choose to specify.

By filling out the Illinois Withholding Allowance Worksheet accurately, you can ensure that the correct amount of state income tax is being withheld from your paycheck each pay period. This can help you avoid owing a large tax bill at the end of the year or receiving a large refund, which means you have been overpaying throughout the year.

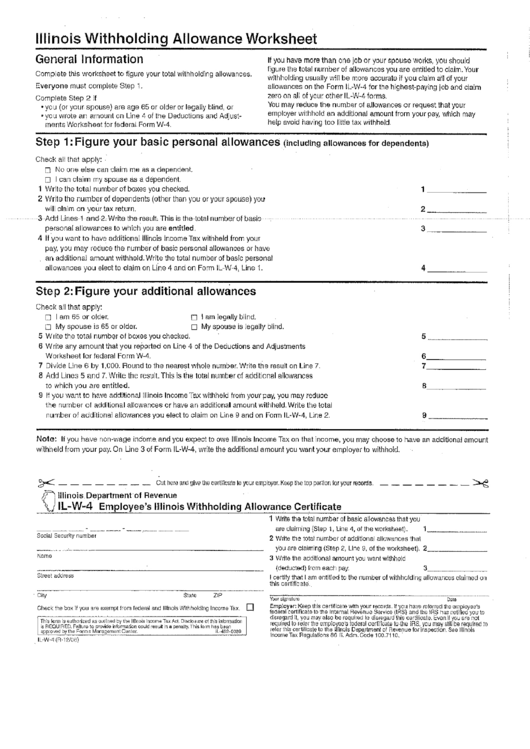

Illinois Withholding Allowance Worksheet

The Illinois Withholding Allowance Worksheet consists of a series of questions and calculations that help you determine your total withholding allowances. These allowances are based on factors such as your filing status, number of dependents, and any additional withholding amounts you specify. By accurately completing this worksheet, you can ensure that the correct amount of state income tax is withheld from your paycheck.

It’s important to review and update your Illinois Withholding Allowance Worksheet regularly, especially if your personal or financial situation changes. For example, if you get married, have a child, or experience a change in your income, you may need to adjust your withholding allowances to reflect these changes accurately.

By understanding and utilizing the Illinois Withholding Allowance Worksheet correctly, you can ensure that you are not overpaying or underpaying your state income taxes throughout the year. This can help you better manage your finances and avoid any surprises come tax time.

Overall, the Illinois Withholding Allowance Worksheet is a valuable tool that can help you accurately calculate and adjust your state income tax withholdings. By taking the time to complete this worksheet correctly and regularly reviewing it, you can ensure that you are on track with your tax obligations and avoid any unnecessary penalties or surprises.

So, the next time you receive your paycheck, take a moment to review your Illinois Withholding Allowance Worksheet and make any necessary adjustments to ensure that you are withholding the correct amount of state income tax. This simple step can help you stay on top of your tax responsibilities and avoid any potential issues down the road.