Creating and maintaining a household budget is essential for managing your finances effectively. A budget helps you track your income and expenses, identify areas where you can cut back, and plan for future financial goals. One useful tool for budgeting is a household budget worksheet, which can help you organize your finances and stay on track with your financial goals.

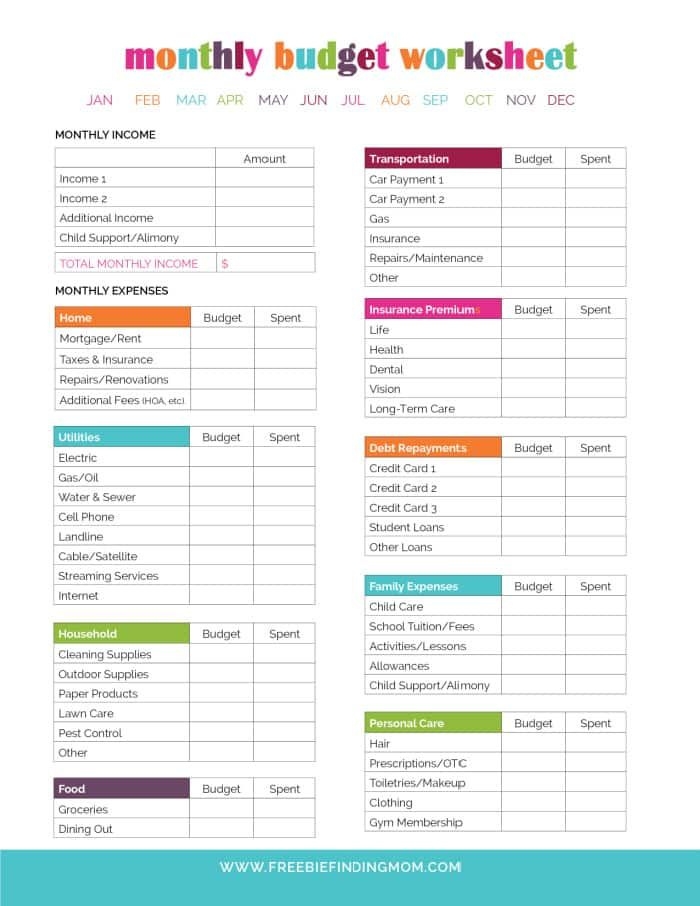

A household budget worksheet is a detailed document that helps you track your income and expenses on a monthly basis. It typically includes categories for income sources, such as salary, investments, and side gigs, as well as expenses like rent/mortgage, utilities, groceries, and entertainment. By filling out a budget worksheet, you can see where your money is going and make adjustments to ensure you are living within your means.

One of the benefits of using a household budget worksheet is that it provides a clear snapshot of your financial situation. By tracking your income and expenses in one place, you can easily see if you are spending more than you earn and make changes accordingly. Additionally, a budget worksheet can help you identify areas where you may be overspending and find ways to cut back on unnecessary expenses.

Another advantage of using a household budget worksheet is that it can help you set and achieve financial goals. Whether you are saving for a vacation, a new car, or a down payment on a house, a budget worksheet can help you allocate funds towards your goals each month. By tracking your progress on a budget worksheet, you can stay motivated and focused on reaching your financial objectives.

In conclusion, a household budget worksheet is a valuable tool for managing your finances and achieving your financial goals. By tracking your income and expenses on a regular basis, you can make informed decisions about your spending, identify areas for improvement, and work towards a more secure financial future. Take the time to create a budget worksheet that works for you and start taking control of your finances today.