When it comes to taxes, understanding the ins and outs of capital gains and qualified dividends can be confusing. However, with the help of a capital gains qualified dividends worksheet, you can easily calculate the amount you owe and ensure you are taking advantage of any potential tax benefits.

Capital gains refer to the profits you make from selling assets such as stocks, bonds, or real estate. Qualified dividends, on the other hand, are dividends paid out by certain types of investments that are taxed at a lower rate. By using a worksheet specifically designed for these types of income, you can determine the amount of tax you owe and potentially reduce your tax liability.

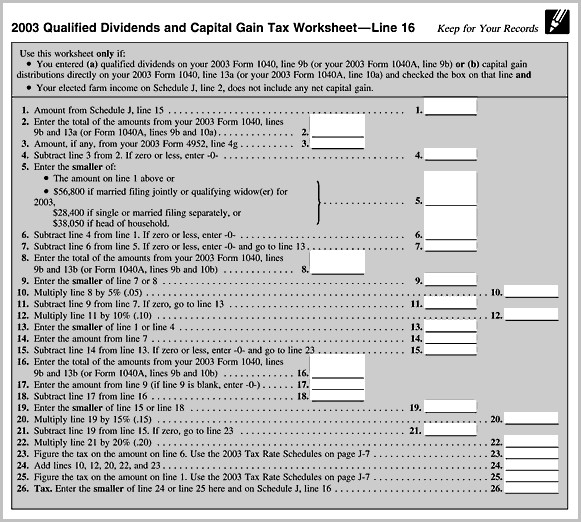

Capital Gains Qualified Dividends Worksheet

A capital gains qualified dividends worksheet typically includes sections for listing your capital gains and qualified dividends separately. You will need to provide information such as the type of investment, purchase price, sale price, and any dividends received. The worksheet will then calculate the total amount of capital gains and qualified dividends you have earned throughout the year.

Once you have determined the total amount of capital gains and qualified dividends, the worksheet will help you calculate the tax owed on these earnings. This can be particularly useful for taxpayers who are looking to minimize their tax liability and take advantage of lower tax rates on qualified dividends.

Additionally, a capital gains qualified dividends worksheet can also help you keep track of your investment income and ensure that you are reporting all earnings accurately on your tax return. This can help you avoid potential audits or penalties from the IRS and ensure that you are in compliance with tax laws.

In conclusion, utilizing a capital gains qualified dividends worksheet can be a valuable tool for taxpayers looking to navigate the complexities of investment income and taxes. By accurately tracking your capital gains and qualified dividends, you can ensure that you are maximizing your tax benefits and reducing your overall tax liability.