For many taxpayers, the Earned Income Credit (EIC) can provide a valuable tax benefit. However, determining the amount of EIC you may be eligible for can be a complex process. This is where the EIC Worksheet comes into play, helping taxpayers calculate their potential credit amount based on their income and family situation.

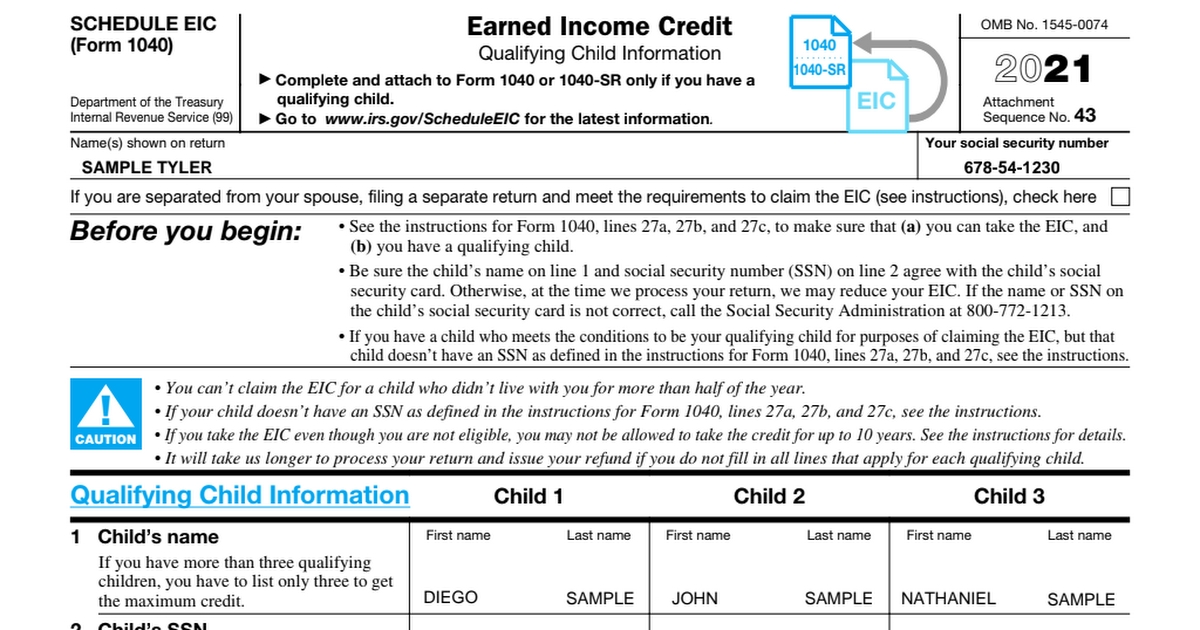

The EIC Worksheet is a tool provided by the IRS to help taxpayers determine their eligibility for the Earned Income Credit. This worksheet takes into account various factors such as income, filing status, and the number of qualifying children in order to calculate the amount of credit a taxpayer may be entitled to receive. By following the instructions on the EIC Worksheet, taxpayers can ensure they are claiming the correct amount of EIC on their tax return.

What is the EIC Worksheet?

The EIC Worksheet is a series of steps and calculations that taxpayers must complete in order to determine their eligibility for the Earned Income Credit. It helps taxpayers figure out their earned income, adjusted gross income, and the amount of credit they may be able to claim based on their specific circumstances. By following the instructions on the worksheet, taxpayers can ensure they are claiming the correct amount of EIC on their tax return.

One key aspect of the EIC Worksheet is determining the filing status of the taxpayer. Whether they are single, married filing jointly, head of household, or qualifying widow(er) with dependent child can have a significant impact on their EIC eligibility. The number of qualifying children a taxpayer has also plays a crucial role in determining the amount of credit they may be able to claim.

Once all the necessary information has been gathered and entered into the EIC Worksheet, taxpayers can determine the amount of EIC they may be eligible for. This credit can result in a significant tax refund for qualifying individuals and families, making it an important tool for those who are eligible.

In conclusion, the EIC Worksheet is a valuable resource for taxpayers seeking to claim the Earned Income Credit on their tax return. By following the instructions provided on the worksheet and accurately entering their information, taxpayers can ensure they are claiming the correct amount of credit. This can result in a significant tax refund for eligible individuals and families, making the EIC Worksheet an important tool for those in need of financial assistance.