As taxpayers, it is essential to stay informed about the latest updates and changes in the tax laws to ensure compliance and minimize liabilities. One crucial aspect to consider is the treatment of qualified dividends and capital gains, which can significantly impact your tax obligations. In 2023, the IRS has released a worksheet to help individuals calculate these amounts accurately.

Qualified dividends and capital gains are taxed at lower rates than ordinary income, providing a tax advantage for investors. However, the eligibility criteria for these preferential rates must be met, and the calculations can be complex. The 2023 Qualified Dividends and Capital Gains Worksheet aims to simplify this process and ensure that taxpayers determine the correct amount of tax owed.

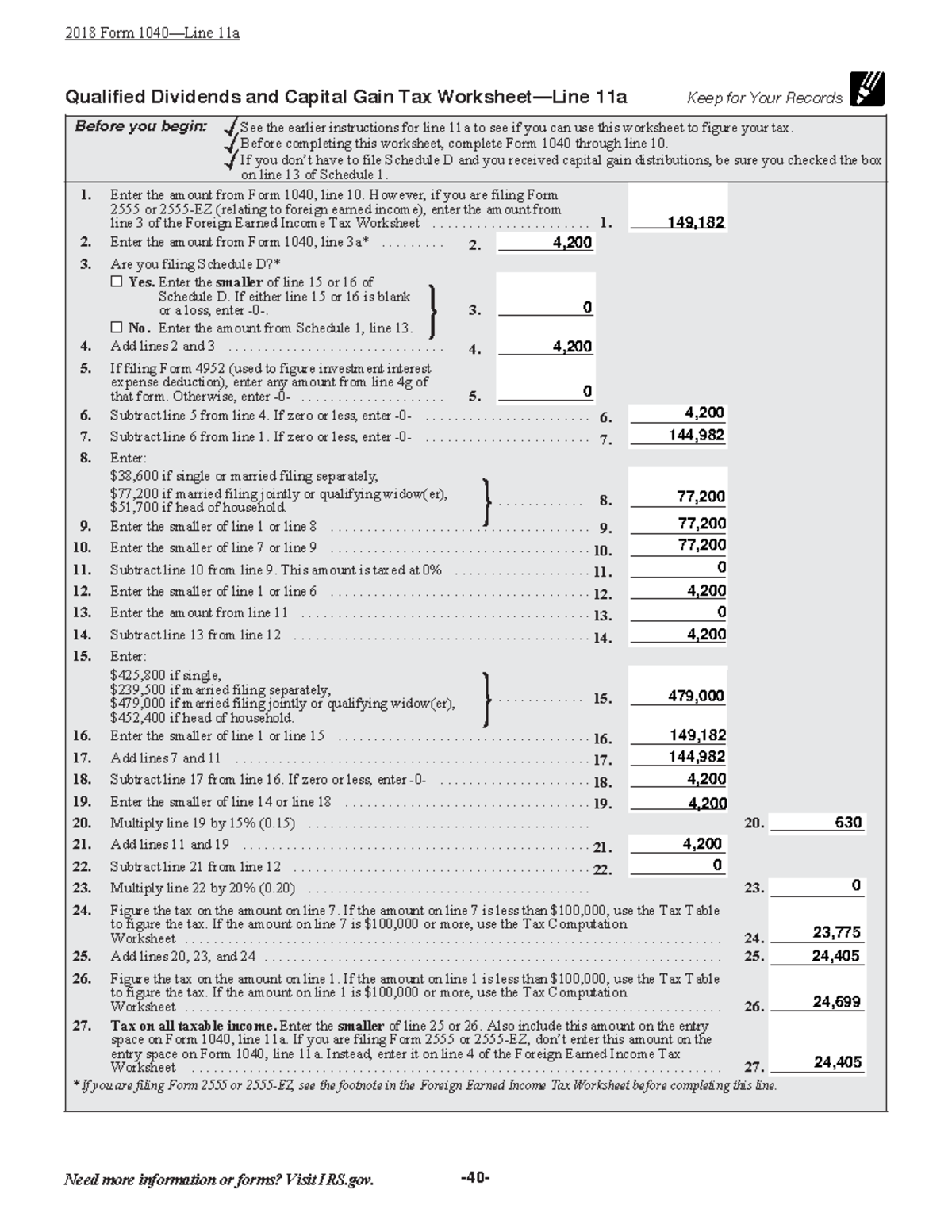

2023 Qualified Dividends and Capital Gains Worksheet

The worksheet provided by the IRS for the tax year 2023 includes detailed instructions on how to calculate your qualified dividends and capital gains. It helps taxpayers determine their taxable income from these sources and ensures that they apply the appropriate tax rates. By following the steps outlined in the worksheet, individuals can accurately report their investment income and fulfill their tax obligations.

One key aspect of the worksheet is the categorization of dividends and gains as qualified or non-qualified. Only qualified dividends and capital gains are eligible for the lower tax rates, while non-qualified amounts are taxed at ordinary income rates. The worksheet guides taxpayers through this classification process and helps them determine the taxable portion of their investment income.

Additionally, the worksheet provides a calculation method for determining the tax rate applicable to qualified dividends and capital gains based on the taxpayer’s filing status and income level. By following the guidelines in the worksheet, individuals can ensure that they pay the correct amount of tax on their investment income and avoid potential penalties or errors in their tax return.

In conclusion, the 2023 Qualified Dividends and Capital Gains Worksheet is a valuable tool for taxpayers to accurately calculate and report their investment income. By following the instructions provided in the worksheet, individuals can ensure compliance with the tax laws and take advantage of the preferential tax rates available for qualified dividends and capital gains. It is essential to utilize this resource to avoid potential errors and optimize your tax filing process.